Amigo (LSE:AMGO) shares rose by a staggering 15% today as of the time of writing. The question now is whether they are still worth buying.

Amigo earnings results

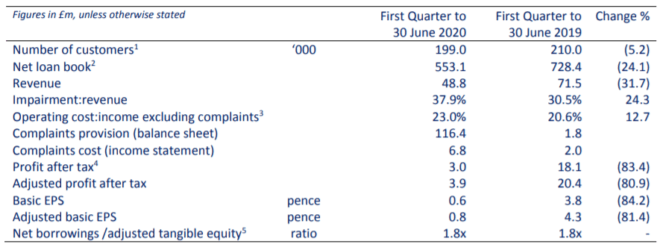

The surge is amazing if we analyse the recent news. Today the company reported its earnings for the three-month period ended on 30 June. Here’s the extract from Amigo’s press release.

Should you invest £1,000 in Abrdn right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Abrdn made the list?

Source: Amigo Holdings

The company’s revenue plunged by almost a third compared to the same period a year ago. The earnings per share (EPS) fell by 84%. The only positive I can see here is that the efficiency indicator (operating cost/income ratio) went down.

At the same time, the poor results reported today are more than explainable. According to the company’s own definition, “Amigo is a leading provider of guarantor loans in the UK and offers access to mid‐cost credit to those who are unable to borrow from traditional lenders due to their credit histories”. In plain terms, it lends money to individuals who are at higher risk of being unable to repay it.

The borrowing costs for such clients tend to be extremely high. Although such businesses are very profitable during good times, they tend to lose a lot during hard times. The Covid-19-related recession we are in now is a perfect example of hard times for such businesses. As we all understand, many people lose their jobs and cannot repay their debts. What’s more, Amigo often lends to people who want to travel but cannot afford to. The coronavirus lockdown was a catastrophe for the travel industry in general. Amigo suffered too. The company even links the dramatic sales revenue reduction to the Covid-19 impact.

The Amigo share price surge

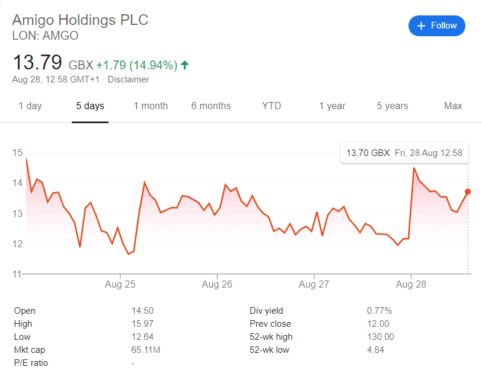

These results were horrible at first sight. It doesn’t seem logical that Amigo stock has surged. As can be seen from the graph below, the shares surged straight after the announcement. In my view, that’s because the market had already priced in a bad scenario. So, buying the stock after a weak earnings report might have looked like a smart move to many investors.

Source: Google Finance

As we can see from the histrical data above, Amigo shares are highly volatile. The 52-week high of 130p is almost 27 times higher than the stock’s 52-week low of 4.84p. This alone makes investing in the company look quite risky to me. Indeed, it looks like investors can gain a lot. At the same time, they can lose a lot too.

Would I buy Amigo shares?

The key question here is what the future holds in store for Amigo. Moody’s rates the company as B3. In other words, the company has a ‘highly speculative’ credit rating. The agency notes that there is hardly any lending activity going on amid the pandemic. So, Amigo’s earnings and revenues will carry on declining until the economic situation gets much better. What’s more, the company also has to deal with a number of customer complaints, as ordered by the Financial Conduct Authority. All that poses significant risks to Amigo. But my colleague Rupert thinks that the business is “setting itself back on track”. Indeed, it still has a substantial cash pile. Although I think Amigo will survive the crisis, it’s still a risky stock. But patient and brave investors might achieve great returns if they buy some Amigo shares.